It may seem so but online shopping is no longer primarily a metropolitan phenomenon. Just as growing digital literacy and widespread internet connectivity drive the trend in smaller cities and towns, significant variations are coming up in the purchasing habits, choices, and mindsets of online shoppers nationwide. A recent PwC report has pointed out that India‘s online shopper is no longer a monolithic entity and businesses that sell online need different strategies for shoppers in big cities and those in small cities and towns.

The report, ‘How India shops online: Consumer preferences in the metropolises and tier 1-4 cities’, divides online shoppers in two distinct categories: those who live in metros and those in the rest of India. It outlines key differences in preferences of online shoppers in these two geographies which can be ignored by digital sellers at their own risk because as e-commerce grows in India these disparities are only going to harden.

What makes them stick

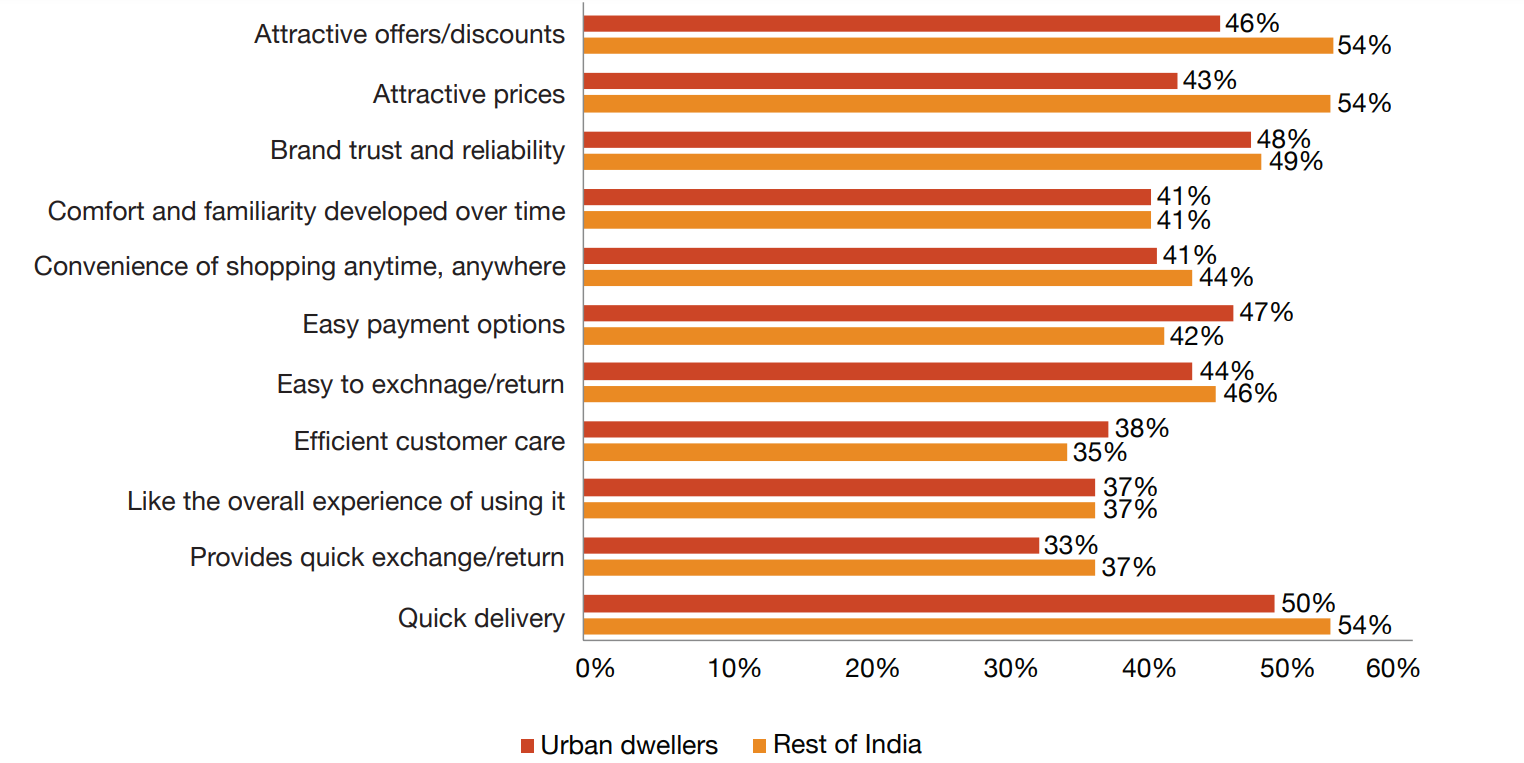

Location can shape buyer preferences in radically different ways. Online shoppers in big cities where traffic jams and long distances are common features of daily life don’t value what shoppers in small towns do where distances are shorter.

Urban dwellers, who prioritise speed in online shopping, are particularly drawn to prompt delivery services which meet their demand for instant gratification and are willing to pay a premium price for the same.

But shoppers in the rest of India are keener on deals. These consumers are bargain and discount

hunters because they live in smaller cities where speed of delivery carries little importance due to short distances.

What are they buying?

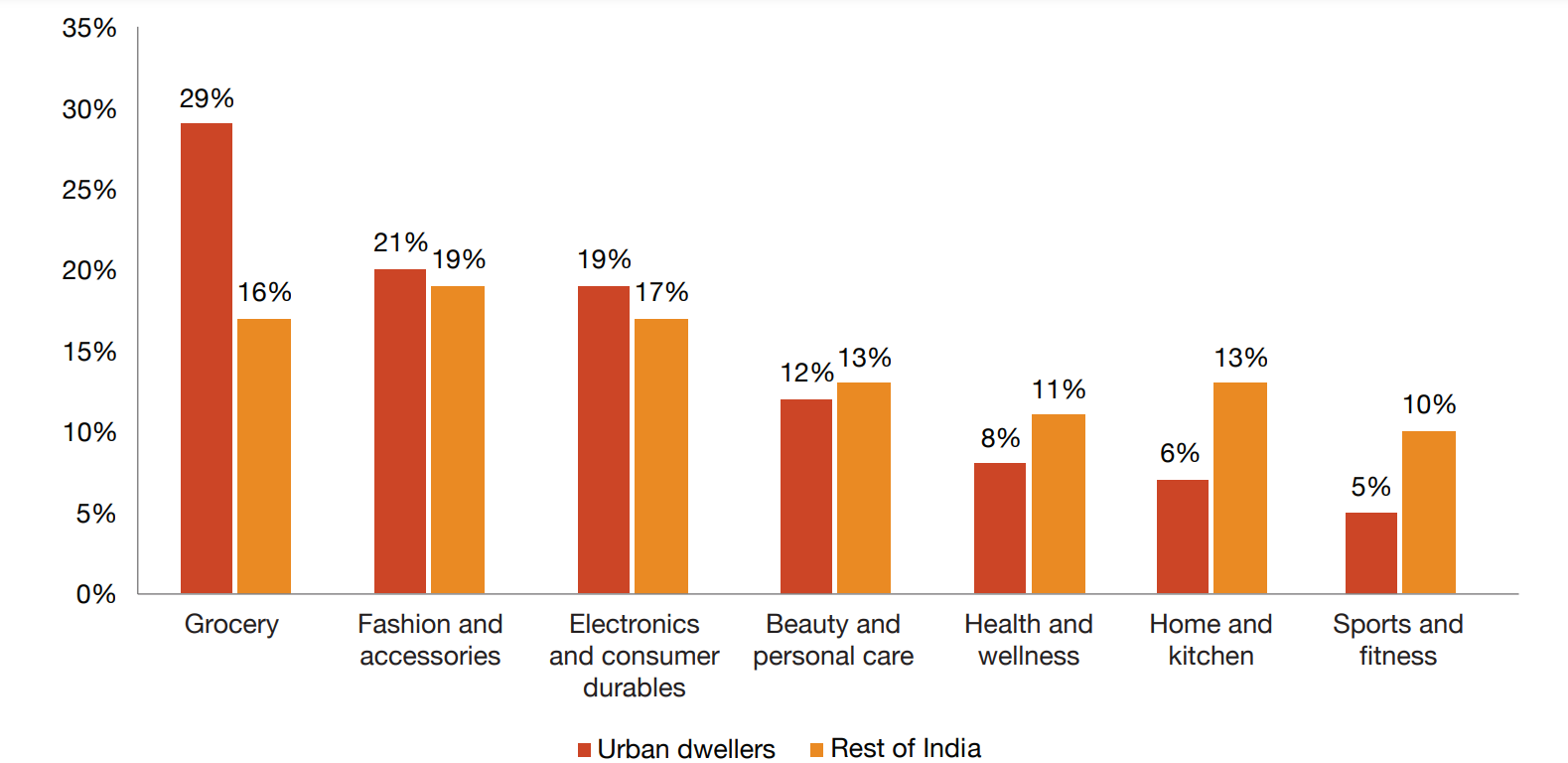

Interestingly, the rest of India appears to be leading the purchases in the sports and fitness, home and kitchen, and health and wellness categories, whereas residents in metros focus more on grocery, electronics and fashion.

The rise of social media has played a significant role in increasing awareness of these products and with an increase in demand, the platforms introduced new and affordable products to these cities. As incomes in the rest of India improved, so did the spending on these categories.

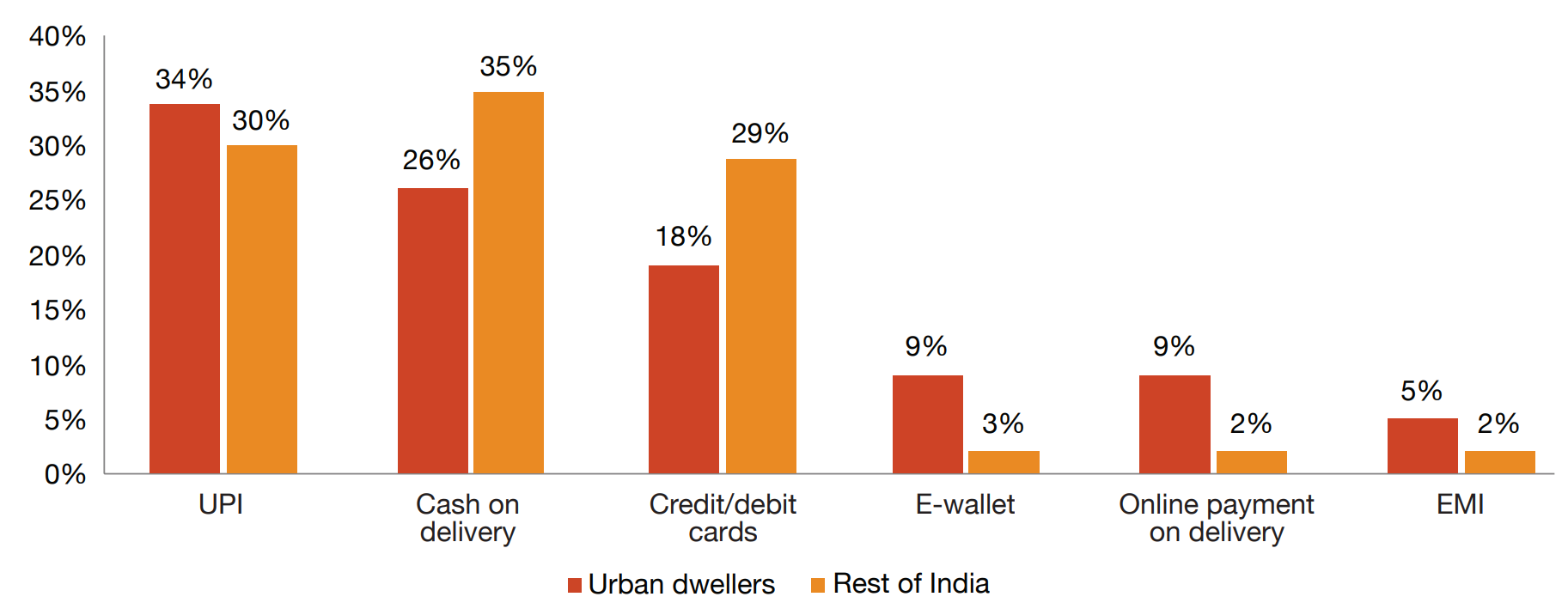

How do they pay?

Those who live in metro cities and those in the rest of India display comparable acceptance levels of UPI payments, indicating a rise in adoption and familiarity with such payment methods.

However, ‘cash on delivery’ remains the preferred option among the shoppers in the rest of India to minimise the risk of frauds. This suggests that while there is growing acceptance of UPI payments due to its convenience, speed and security, there are still concerns regarding online platforms and payment methods particularly among shoppers in the rest of India.

Generation X from the rest of India prefers card transactions for mid-high value purchases on well-known platforms due to their direct connection to bank accounts, providing a trusted layer of transaction safety. Paytm is popular among urban dwellers for its user-friendly wallet while PhonePe is preferred by the rest of India because of its intuitive interface. Google Pay ranks second nationwide.

What unites the two categories

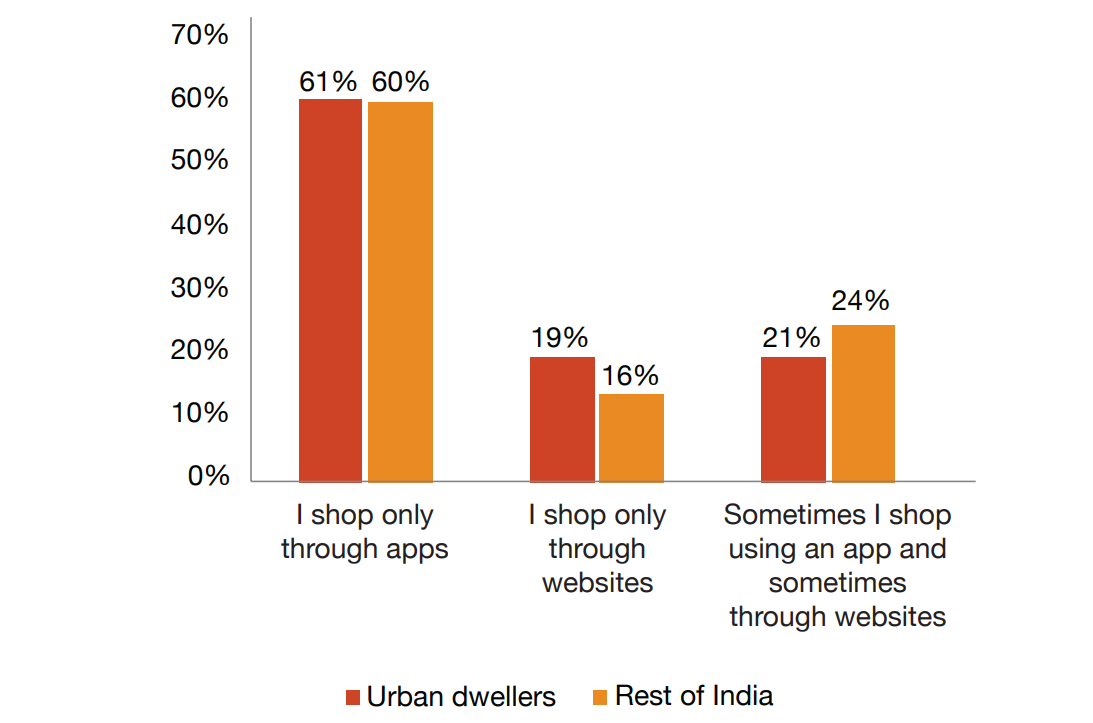

Shoppers of both the categories prefer apps to websites to shop online. This is common for all the respondents irrespective of their geographic location. The factors for this preference are ease of navigation, simplified user interface (that complies to global standards) and vernacular support.

Marketplace apps often also get downloaded more since they cater to a wide range of categories. For customer service and assistance consumers prefer human interaction over interacting with chatbots.

Marketplaces or category platforms?

With a combination of fashion and accessories, marketplaces still have a lion’s share of the consumer market irrespective of the geography. Amazon’s market pull in the urban markets beats Myntra’s by a small margin while Flipkart has caught the fancy of the nation in the rest of India followed by Meesho, Amazon and Myntra. This preference for marketplace apps over category-based platforms is a common theme among rest of India respondents highlighting the importance of factors such as deals, discounts, accessibility, user-friendly interfaces and familiarity with the platform.

The need for tailored solutions

Designing experiences that resonate with all the users across the country may not be the best way forward for digital sellers. The e-commerce experience that has worked in the urban centres may not necessarily work for the rest of India. The latter will need a more in-depth, human-centric view that acknowledges and capitalises on the diversity that exists across in these smaller towns and cities.

“The report emphasises the need for tailored e-commerce experiences to resonate with diverse users across India,” says Prateek Sinha, Partner and Leader – Design and Experience Consulting, PwC India. “A human-centred approach, coupled with localised strategies and inclusivity, is crucial for success. It’s about connecting with each customer on a personal level, celebrating the rich tapestry of our cultures, and innovating every step of the way. By embracing agility and a deep understanding of consumer dynamics, businesses can chart a trajectory of sustained growth and profitability. When businesses get this right, they’re not just selling products; they’re creating experiences that people love and trust.”