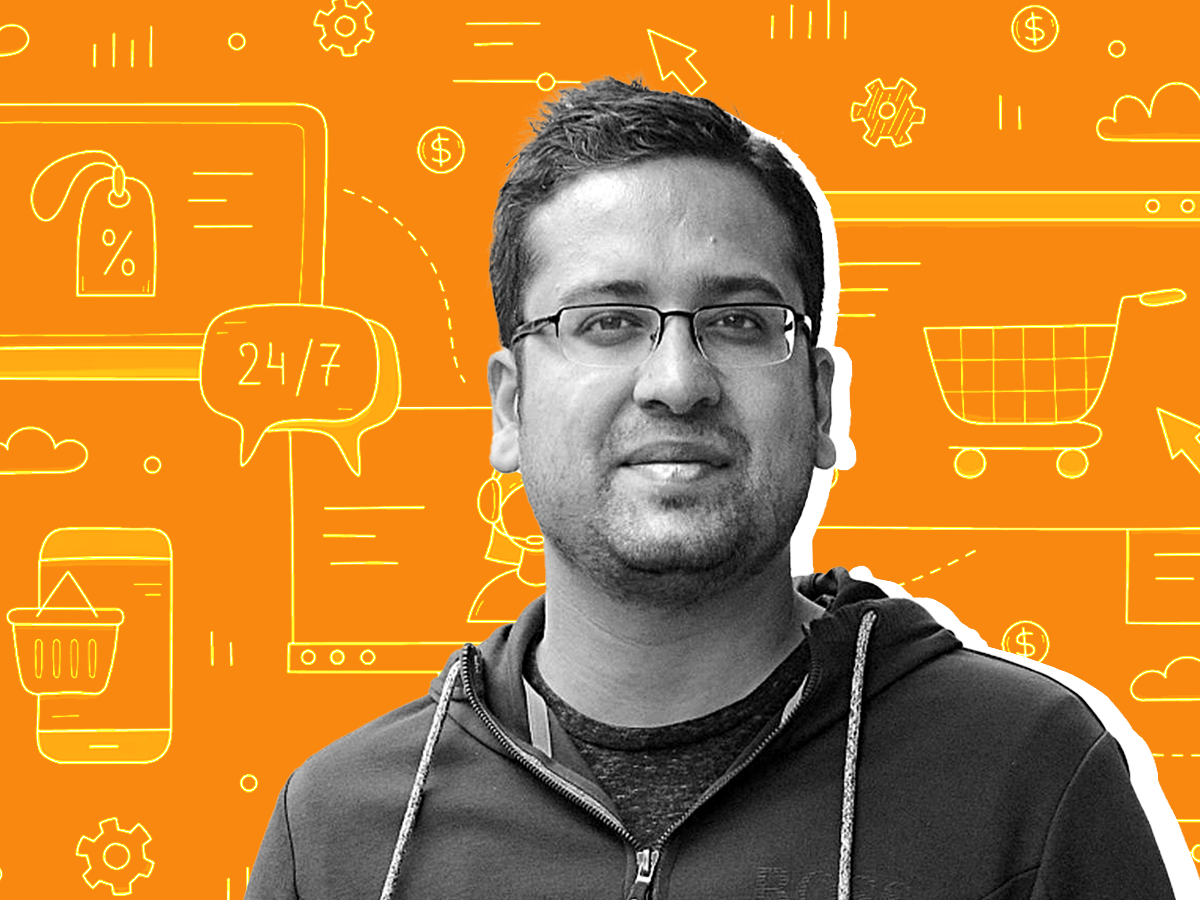

Binny Bansal’s Three State Ventures funds new startup OppDoor, ET Retail ALI SHIPPING INDIAN DROPSHIPPING

Flipkart founder Binny Bansal has invested just under $2 million in his new venture, OppDoor, through venture fund Three State Ventures, according to recent Singapore regulatory filings seen by ET.

OppDoor is a software services platform that aims to help emerging online retail brands expand globally.

Three State Ventures is the investment vehicle of Bansal, sponsored through his personal capital. It invested the money via multiple tranches over the past few months, the filings showed. The latest cash infusion was in February.

The latest investment may be relatively smaller in size, but indicates the bet the IIT-Delhi alumnus is taking on his new venture.

Bansal resigned from Flipkart’s board in January as reported first by ET, formally ending his ties with Flipkart. He has been using capital from the Flipkart share sale to fund his ventures that in turn invest in other startups.

An email sent to Bansal did not immediately elicit any response. It is not clear yet if Bansal will raise capital from external investors for his venture.

OppDoor has been in talks with former senior Flipkart group executives to induct them. Simultaneously, it made several hirings in Bengaluru for various roles. The company currently is offering ecommerce business-related services to Amazon’s US brands in international markets.

Bansal, who shifted his base to Singapore after exiting from the operating role in Flipkart in 2018, has been a frequent visitor to Bengaluru over the past year.

A few months after Walmart’s acquisition of Flipkart in 2018, Bansal stepped down from his role as Flipkart Group chief executive, following allegations of serious personal misconduct, according to a statement issued by Walmart in November that year. He was, however, exonerated of the charges after an internal investigation at the etailer.

Bansal continued to hold his board position. Late last year, he sold his remaining stake in the firm netting about $650 million. He has been selling his stake in parts to Walmart and other investors in Flipkart before making a full exit. Walmart, the US-based retailer, now holds 80.5% in Flipkart.

Curefoods, PhonePe and Acko are among top startup bets of Bansal where he has put in significant funds over the years.